0+

Combined Years of Experience

0M+

Invested Capital

0+

Portfolio Companies

0

Funds

Based in Columbus, Ohio, Oxer Capital partners with private equity firms, independent sponsors, family offices, and management teams to provide junior capital to lower middle market companies throughout the United States. Since 2016, Oxer has invested over $595 million across 95+ portfolio companies. We are currently investing out of our third fund, totaling ~$229 million.

Our Strategy

Oxer seeks to provide flexible, tailored solutions aligned with client needs which may consist of subordinated debt, structured equity, and minority equity stakes. Our typical investment size ranges from $2 – 12 million, although we may lead or participate in larger investments by co-investing with our limited partners or other junior capital providers.

Our Values

Our investment professionals strive to be diligent, thoughtful, and responsive in evaluating new opportunities. Our collaborative and nimble approach provides speed to close and certainty of execution. We work to cultivate trust and nurture long-term relationships with our investors and investment partners.

Investment Criteria

$10 – 100 Million

Revenue

$1 – 10 Million

EBITDA

$2 – 12 Million

Investment Size

Company Characteristics

- Sustainable Margins

- Proven Business Strategy

- Stable or Expanding Industry

- Competitive Market Position

- Experienced & Invested Management Team

- Based in U.S.

Transaction Types

- Acquisitions

- Growth

- Leveraged Buyouts

- Recapitalizations

- Shareholder Liquidity

- Management Buyouts

- ESOP Transactions

Investment Structures

- Subordinated Debt

- Structured Equity

- Minority Equity

- One-Stop Financing

Our Team

With over 100 years of collective experience investing in and advising lower middle market companies, we understand the needs and concerns of owners and managers. We have originated over $815 million in investments in over 155 companies across a diverse group of industries. Our networks and experience are shared to benefit our clients and partners.

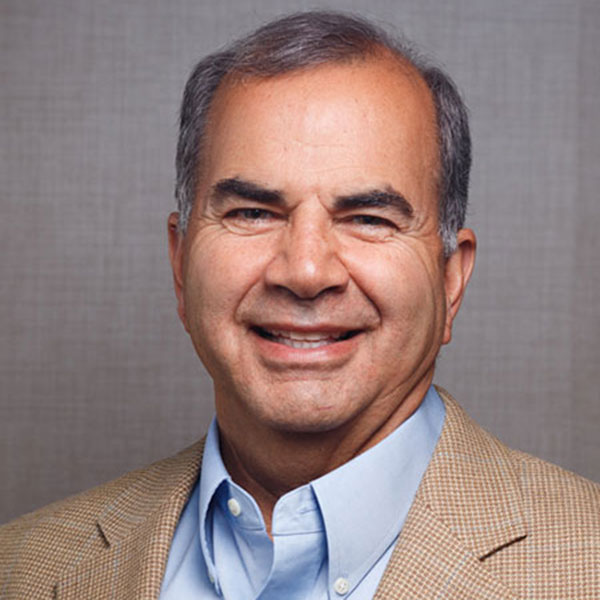

Frank Capella

Founding Partner

Daniel D. Phlegar

Founding Partner

Michael O’Brien

Partner

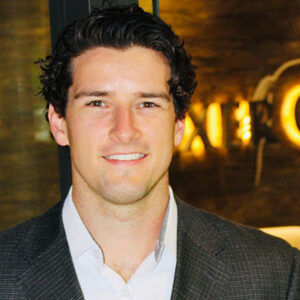

Blake Sousa

Managing Director

Derek Snyder

Vice President

Conner Kesner

Sr. Associate

Carter Richardson

Associate

Michael Affinito

CFO

Andi Tobe

Accounting ManagerOur Portfolio

AllFund IFund IIFund IIICurrentExited

Ascot Enterprises

Signum

Pies & Pints

Calimira (Rusty Bucket)

BA Securities

Undisclosed HVAC Business

Cornerstone

EDSCO

Rugs Direct

Specialty Tile Products

Mason Structural Steel

PC Server

Encore Boat Builders

Auxo Die Holdings

Nu-Life Environmental

Hub Plastics

Matri Holdings

Gem City Engineering

Blue Ridge Mountain Rentals

Insight 2 Design

Securit Metal Products

Encap

Integrated Behavioral Health

C&M Conveyor

Fecon Holdings

Antenna Research Associates

Futuri Media

Davidson Steel

W.A. Jones

Quaker Hospitality

Managed Packaging Systems

Rosman Search

Advanced Communications Technology

Mediu

D&H United

Integrated Laboratory Systems

Service Star

PEScience

Kelly Roofing

Electromechanical Research Laboratories

Nickson Industries

Integrated Behavioral Health

GreenTech Environmental

Peerless Midwest

Kabinart

Financial Aid Services

Miljoco

Ecotone

Westwater Supply Corp

Bridgestone Restaurant Group

Titanus

Steel City Wash

Rainier

Yak Attack

Boride

Safe-Way Garage Doors

Securit Metal Products

CW Conveyor Holdings

Jeni’s Ice Creams

Henry’s Wrecker

Tuff Turf

Stylecraft

Paxton Patterson

Sticker Cabana

American Professional Quilting Systems

LaserGifts

Traverse City Products

Barefoot Mosquito & Pest Control

Vigilnet

Smile Source

West Kentucky Correctional Healthcare

Empower Manufacturing

Cosmetic Skin & Laser Center

ShopSabre

Jurassic Quest

Spire Collective

The Brighton Group

SisTech Manufacturing

Sweet Tooth

ARK Therapeutic

Kosmos Q

Current Tools

Salt River Aviation

Heritage Imaging

Dynamic Facility Services

American Roadway Logistics

Fairwood Brands

ASAP Garage Door Repair

Chippewa Concrete Services

Royal Arc

Iron City Waste Holdings

Science Interactive

Floorguard Products

Library Furniture Holdings

Amspak

Glass Concepts

Midwest Fasteners

Chamblee Fence Company